The Financial Ombudsman Service (FOS) received a total of 95,349 complaints between 1 July and 31 December 2023, which represented an increase of almost 20% to the same period in 2022, when 79,921 complaints were accepted.

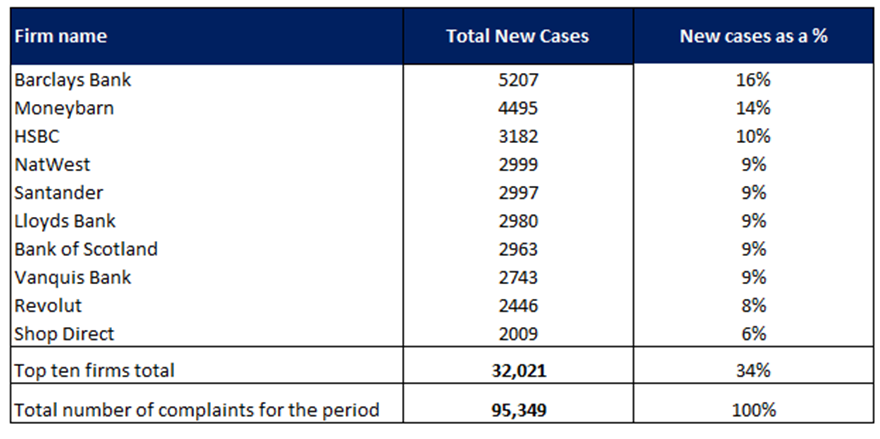

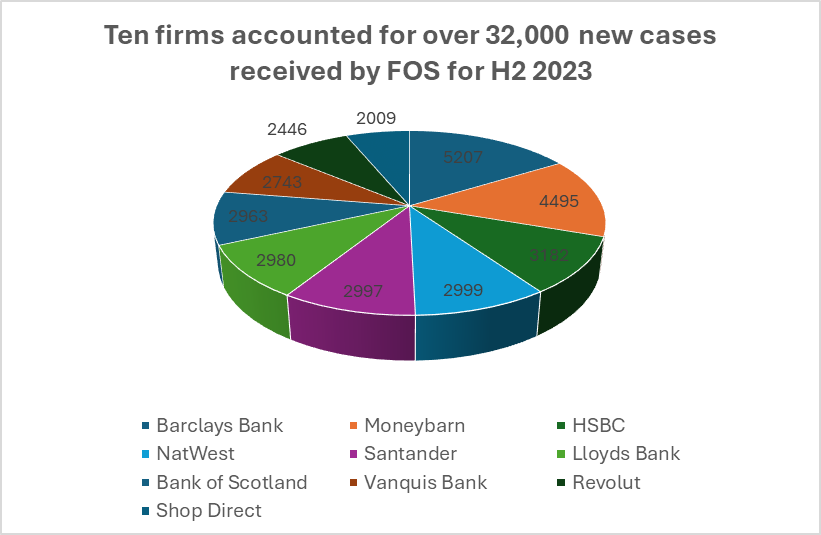

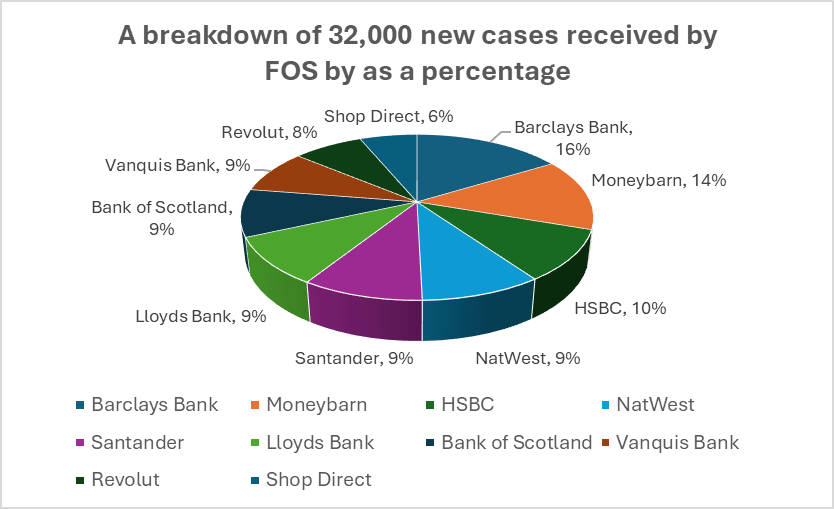

For H2, 2023, ten firms accounted for 32,021 complaints, where the majority of cases were against three of the big four banks (Barclays, HSBC, Barclays and NatWest), and Moneybarn, a car finance and loan company.

The breakdown was as follows:

FOS received complaints about 236 firms for the second half of 2023, whereas 212 firms featured for the same period in 2022.

In the second six months of the year, FOS upheld 36% of complaints in the consumers’ favour, compared to 34% in the second half of 2022.

FOS said: “Banking and consumer credit related complaints were the main driver of the rise in cases,” with current account and credit cards accounting for over 40% of the complaints received in the banking sector.

The Service added: “Credit card complaints were driven by perceived unaffordable and irresponsible lending, reflecting the insight we shared in March 2024 about credit card complaints hitting an all-time high.”